Equation for sales tax

As a general rule goods are subject to sales tax at a rate of 10 however some goods are taxed at the reduced rate of 5 specific rates and others are specifically exempt. Sales tax rates by state.

How To Calculate Sales Tax Definition Formula Example

While many factors influence business location and investment decisions sales taxes are something within policymakers control that can have immediate impacts.

. 2020 sales tax rates differ by state but sales tax bases also impact how much revenue is collected and how it affects the economy. Explore 2021 sales tax by state. The Other Half of the Equation.

Compare 2021 sales tax rates by state with new resource. This may be accounted for by. In addition in 38 states an additional local.

Delivering tax services insights and guidance on US tax policy tax reform legislation registration and tax law. While many factors influence business location and investment decisions sales taxes are something within lawmakers control that can have immediate impacts. The Other Half of the Equation.

255 divided by 106 6 sales tax 24057 rounded up 1443 tax amount to report. California has the highest state-level sales tax rate at 725 percent. Gross sales Sum of all sales Total units sold Sales price per unit.

This amount includes the cost of the materials used in. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. JEL Classification System EconLit Subject Descriptors The JEL classification system was developed for use in the Journal of Economic Literature JEL and is a standard method of classifying scholarly literature in the field of economicsThe system is used to classify articles dissertations books book reviews and working papers in EconLit and in many other.

Cost of goods sold COGS is the direct costs attributable to the production of the goods sold in a company. Get ready for 4th grade. They have one statewide sales tax rate which generally ranges from 4-7 meaning you only need to charge that single rate when you have nexus.

The media business is in tumult. For instance most. Sales tax is charged by registered manufacturers of taxable goods and on the importation of taxable goods into Malaysia.

Find stories updates and expert opinion. An operating expense is an expense a business incurs through its normal business operations. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

The margin and sales tax calculator combines these two issues for your ease - anyone selling anything will need to find the net and gross price based on their desired margin and the sales tax rate at some point. State sales tax bases can vary greatly. For the PV systems shown in Figure 36 this adds 2030 to customer acquisition costs.

Get ready for 3rd grade. Compare 2022 sales taxes including 2022 state and local sales tax rates. 86-272 still may be subject to a states sales and use tax and other non-income tax based taxes eg franchise taxes based on net worth.

Get 247 customer support help when you place a homework help service order with us. Often abbreviated as OPEX operating expenses include rent equipment inventory. The Other Half of the Equation.

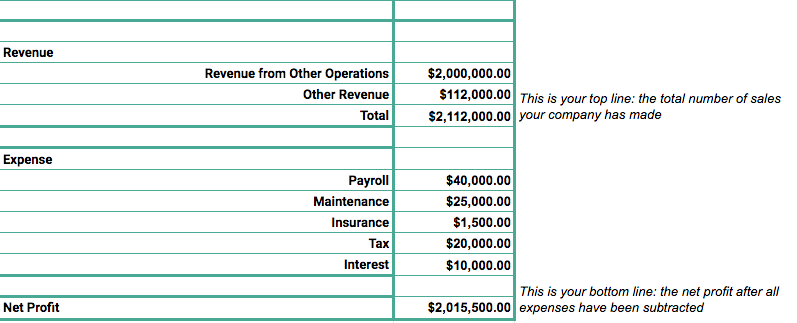

A handful of states are fairly simple. In business and accounting net income also total comprehensive income net earnings net profit bottom line sales profit or credit sales is an entitys income minus cost of goods sold expenses depreciation and amortization interest and taxes for an accounting period. For example if the sales tax rate is 6 divide the total amount of receipts by 106.

An asset classified as wasting may be treated differently for tax and other purposes than one that does not lose value. The tax basewhat is and isnt taxablecan have a significant impact on the competitiveness of different sales tax regimes and the efficiency with which they raise revenue. Mediagazer presents the days must-read media news on a single page.

2021 state and local sales tax rates. It relates assets liabilities. Sales tax is governed at the individual state level so tax rules and regulations are slightly different from state to state.

The accounting equation is the mathematical structure of the balance sheet. To calculate the sales tax that is included in receipts from items subject to sales tax divide the receipts by 1 the sales tax rate. To calculate the sales tax rate you would use the following equation.

It is computed as the residual of all revenues and gains less all expenses and losses for the period. Sales tax rate Sales tax amount Pre-tax price. From the production side to the distribution side new technologies are upending the industry.

Statewide sales taxes are collected by 45 states and the District of Columbia. Accordingly an entity with employees engaged only in the solicitation of sales of tangible personal property within a state which otherwise is protected from income tax nexus under PL. Please contact Savvas Learning Company for product support.

This report ranks states based on tax rates and does not account for differences in tax bases eg the structure of sales taxes defining. Sales tax rates arent the only factor that matters. We also assume the sales and marketing costs for PVBESS includes the cost of 20 more hours for a DC-coupled system and 32 more hours for an AC-coupled system than would be included for a PV-only system installation Feldman et al 2021 Table 10.

The Other Half. Feel free to calculate anything you like - you may be interested in how much you of your payment is going to the wholesaler if you provide the. Well use algebra to solve this percent problem.

To calculate gross sales determine the total sales before deductions ie sales or returns. The Times obtained Donald Trumps tax information extending over more than two decades revealing struggling properties vast write-offs an audit battle and hundreds of millions in debt coming due. 2020 sales tax rates.

In the above example the sales tax rate would be 2 16 87. Latest breaking news including politics crime and celebrity. Get ready for 5th grade.

For example gross sales dont account for costs associated with item production employee wages building rent returns theft or sales tax. Cost of Goods Sold - COGS.

Sales Tax Lesson For Kids Study Com

Chapter 9 Taxes Start Exit Ppt Download

Profit Before Tax Formula Examples How To Calculate Pbt

Gov Tax Sales Tax Elasticity Tax Burden Tax Incidence Youtube

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Sales Revenue Formula Calculate Grow Total Revenue

How To Figure Out And Calculate Sales Tax Math Wonderhowto

Ex Find The Sale Tax Percentage Youtube

How Do You Figure Out Sales Tax Virtual Nerd

Sales Tax Calculator

Sales Tax Calculator

How To Calculate Sales Tax In Excel

How To Calculate Sales Tax In Excel

Excel Formula Tax Rate Calculation With Fixed Base Exceljet

How To Calculate Sales Tax In Excel

Reverse Sales Tax Calculator